- #HOW TO GRAPH EFFICIENT FRONTIER IN EXCEL FULL#

- #HOW TO GRAPH EFFICIENT FRONTIER IN EXCEL TRIAL#

- #HOW TO GRAPH EFFICIENT FRONTIER IN EXCEL SERIES#

- #HOW TO GRAPH EFFICIENT FRONTIER IN EXCEL FREE#

#HOW TO GRAPH EFFICIENT FRONTIER IN EXCEL FREE#

Remember that a share and like helps us grow and we will continue to provide FREE Python related tutorials.

#HOW TO GRAPH EFFICIENT FRONTIER IN EXCEL FULL#

The full source codeīelow here you find the full source code from the tutorial. Also, the theory builds upon that investors are rational in their investment, which is by most considered a flawed assumption, as more factors play into the investments. As investopedia points out, it assumes that asset returns follow a normal distribution, but in reality returns can be more the 3 standard deviations away. The theory behind has some assumptions that may not be a reality. How often should you re-balance? It has a cost to do that.

#HOW TO GRAPH EFFICIENT FRONTIER IN EXCEL TRIAL#

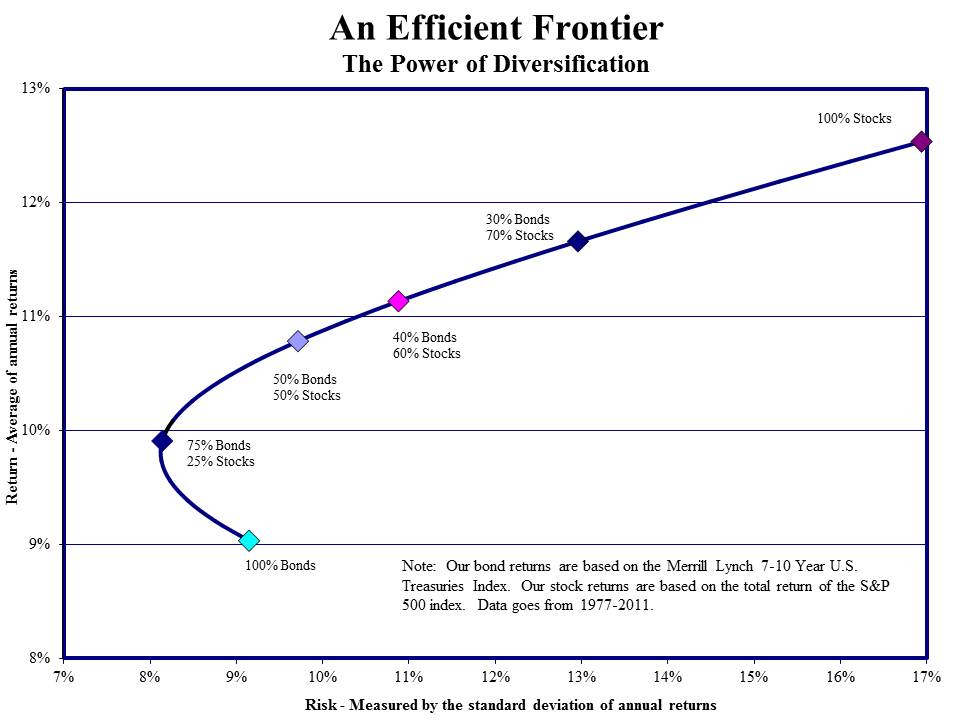

The above code can by trial an error find such a portfolio, but it still leaves out some consideratoins. The Efficient Frontier gives you a way to balance your portfolio. Hence, given a risk, the optimal portfolio is one corresponding on the upper boarder of the filled parabola. The optimal values lie along the upper half of the parabola line. This shows a graph which outlines a parabola. The standard deviation (assigned to sigma) is calculated similar by the formula given in the last step: variance = w^T Cov w (which has dot-products between). The transpose is only about the orientation of it to make it work. What a dot-product of np.dot(w, cagr.T) does is to take elements pairwise from w and cagr and multiply them and sum up. This is done by using NumPy’s dot-product function. Then we iterate 20.000 times (could be any value, just want to have enough to plot our graph), where we make a random weight w, then calculate the expected return by the dot-product of w and cagr-transposed. This will give a way to distribute our portfolio of stocks. That is, it returns a vector with entries that sum up to one. We introduce a helper function random_weights, which returns a weighted portfolio. Plt.plot(sigma, exp_return, 'ro', alpha=0.1) Sigma.append(np.sqrt(np.dot(np.dot(w.T, cov), w))) This results in the following pre-computations. Given a weight w of the portfolio, you can calculate the variance of the stocks by using the covariance matrix. For example, given w =, will say that we have 20% in the first stock, 30% in the second, 40% in the third, and 10% in the final stock. Remember that the standard deviation is given by the following.Ī portfolio is a vector w with the balances of each stock. We will also calculate the covariance as we will use that the calculate the variance of a weighted portfolio. The key thing is to have some common measure of the return.ĬAGR = (end-price/start-price)^(1/years) – 1

An alternative that also is being used is the mean of the returns. The CAGR is used as investopedia suggest. To calculate the expected return, we use the Compound Average Growth Rate (CAGR) based on the last 5 years.

Step 2: Calculate the CAGR, returns, and covariance

#HOW TO GRAPH EFFICIENT FRONTIER IN EXCEL SERIES#

It will contain all the date time series for the last 5 years from current date.

0 kommentar(er)

0 kommentar(er)